Simple ROI Calculator

Annual ROI Calculator

Introduction

In the world of finance and investment, the term ROI, or Return on Investment, holds paramount significance. ROI is the yardstick by which individuals and businesses assess the profitability and effectiveness of their financial choices. Making informed financial decisions is pivotal for both personal and professional success.

When it comes to investment decisions, ROI is the ultimate litmus test. It provides a clear and quantifiable measure of how well an investment has performed. Whether you’re considering investing in stocks, real estate, a new business venture, or even your education, ROI can help you evaluate the returns on your investment. But to harness the full power of ROI, it’s essential to comprehend its definition, formula, and practical applications.

What is ROI?

Defining ROI

At its core, Return on Investment, or ROI, is a financial metric used to gauge the profitability of an investment. ROI is often expressed as a percentage and represents the ratio of net gain to the net cost of an investment. In simple terms, it answers the question: “How much money did I make relative to what I spent?”

Components of ROI

To calculate ROI accurately, you need to consider two primary components:

- G (Gain from Investment): This represents the income or profit generated by the investment.

- C (Cost of Investment): This includes the total expenses associated with the investment, including initial purchase costs and any subsequent expenditures.

ROI as a Percentage

ROI is typically expressed as a percentage, making it easier to compare the profitability of different investments. A higher ROI percentage indicates a more favorable investment, while a lower ROI suggests a less profitable venture.

Other Measures Related to ROI

Beyond the standard ROI calculation, several related metrics help in assessing investments:

- ROIC (Return on Invested Capital): Focuses on the efficiency of capital utilization.

- Average Rate of Return: Provides an average annual return over a specified period.

- Return on Equity (ROE): Measures the profitability of shareholder equity.

- Earnings per Share (EPS): Reflects a company’s profitability on a per-share basis.

Understanding these related measures can provide a more comprehensive view of an investment’s performance and financial health.

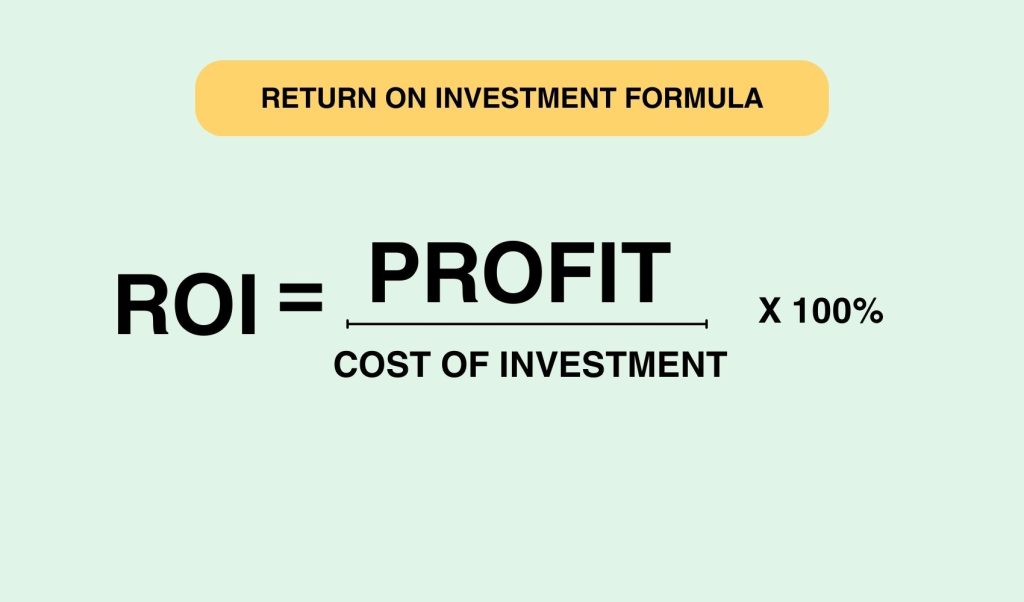

ROI Formula

Calculating ROI

The ROI formula is relatively straightforward:

ROI=(G –C) / ×100

In this formula:

- G represents the gain from the investment.

- C denotes the cost of the investment.

Role of the ROI Formula

The ROI formula serves as a critical tool for investment decisions. By plugging in the appropriate values, investors can quantify the profitability of their choices. This, in turn, helps them make informed decisions about where to allocate their resources.

Limitations of the ROI Formula

While ROI is a valuable metric, it’s essential to recognize its limitations. One significant limitation is that ROI does not account for the time value of money. It treats all gains and costs equally, regardless of when they occur. Additionally, ROI may not provide a complete picture for long-term investments with fluctuating returns.

Examples of ROI Calculation

Now, let’s delve into real-world scenarios to see how ROI calculations work in practice. These examples will illustrate the concept and demonstrate how to calculate ROI in different investment scenarios.

Example 1: Stock Investment

Imagine you invested $10,000 in a tech company’s stock. After one year, the value of your investment has grown to $12,000, and you’ve received $500 in dividends. To calculate the ROI:

G=(12,000+500)−10,000=2,500

C=10,000

ROI= (2,500−10,000) / 10,000 ×100= 25

Your ROI for this stock investment is 25%, indicating a profitable venture.

Example 2: Real Estate Investment

Suppose you purchased a rental property for $200,000. Over the course of a year, you earned $18,000 in rental income, but you also incurred $8,000 in maintenance and operating expenses. To calculate the ROI:

G=18,000−8,000=10,000

C=200,000

ROI= (10,000−200,000)/ 200,000 ×100 = 5

In this real estate investment, your ROI is 5%, indicating a lower return compared to the stock investment.

Example 3: Business Expansion

If you’re a business owner looking to expand, you may invest $50,000 in a new product line. After a year, the new product generates $20,000 in additional revenue, but you also incur $10,000 in marketing and operational expenses. To calculate the ROI:

G=20,000−10,000=10,000

C=50,000

ROI=50,00010,000−50,000×100=−80

In this business expansion scenario, your ROI is -80%, indicating a loss on the investment.

These examples showcase the versatility of ROI calculations in assessing various investment types. They also highlight the critical role of ROI in making informed financial decisions.

Example 4: Education Investment

Suppose you decide to pursue an MBA program that costs $50,000 in tuition and incurs an additional $10,000 in living expenses. After completing your degree, you secure a job with an annual salary increase of $20,000 compared to your previous job. To calculate the ROI:

G=20,000

C=50,000+10,000=60,000

ROI=60,00020,000−60,000×100=−66.67

In this scenario, your ROI for education is -66.67%, indicating a negative return due to the significant costs associated with the degree.

Example 5: Startup Investment

You invest $25,000 in a startup company by purchasing equity shares. After two years, the startup is acquired, and your shares are sold for $100,000. However, you also invested an additional $5,000 during the two years to support the company’s growth. To calculate the ROI:

G=100,000−5,000−25,000=70,000

C=25,000

ROI=25,00070,000−25,000×100=180

In this startup investment scenario, your ROI is 180%, indicating a highly profitable venture.

These additional examples demonstrate how ROI calculations can be applied to diverse situations, including education and startup investments, to assess their financial viability.

Return on Investment Calculator

Understanding the ROI formula is crucial, but for quick and precise calculations, especially in complex scenarios, it’s beneficial to use a return on investment calculator. These tools are readily available online and can streamline the process of assessing investments. Here’s how to use an Return on Icalculator effectively:

- Input Data: Gather all the relevant financial data, including the initial investment cost (C), gains from the investment (G), and any additional expenses.

- Choose the Calculator: Find an ROI calculator online that suits your specific investment type. Some calculators are tailored for stocks, real estate, or business ventures.

- Enter Values: Input the collected data into the calculator.

- Calculate: Click the “Calculate” button or perform the calculation based on the calculator’s instructions.

- Interpret Results: Review the calculated ROI percentage, which will indicate whether your investment has been profitable or not.

Return on Investment calculators are versatile tools applicable to a wide range of businesses and investments. They eliminate the need for manual calculations, saving time and reducing the risk of errors.

ROI and Financial Decisions

ROI is not just a number; it’s a powerful tool for estimating net investment benefits and making rational financial decisions. Here’s how ROI plays a vital role in shaping financial choices:

Estimating Net Investment Benefit

ROI allows investors to gauge the net benefit of their investments. By subtracting costs from gains, they can see the actual profit generated. This insight is invaluable for assessing whether an investment aligns with financial goals.

Decision Criteria Based on ROI

Investors often set ROI thresholds as decision criteria. For instance, they may decide to invest in projects or assets only if the expected ROI exceeds a certain percentage. This helps filter out less promising opportunities and focus resources on more profitable ones.

Investment Project Assessment

In the business world, ROI is used extensively to assess investment projects. Companies analyze potential projects, such as launching a new product or expanding into new markets, by comparing the expected ROI with the company’s cost of capital. If the ROI exceeds the cost of capital, the project is typically considered viable.

ROI, therefore, serves as a compass guiding businesses and individuals toward ventures that align with their financial objectives.

ROE vs. ROI

It’s essential to differentiate between Return on Investment (ROI) and Return on Equity (ROE) as they serve distinct purposes:

ROI (Return on Investment)

- Focuses on the profitability of an entire investment.

- Compares the gain to the total cost of the investment.

- Not limited to investments in equities (stocks).

ROE (Return on Equity)

- Concentrates on the profitability of shareholder equity.

- Compares the net income to shareholders’ equity.

- Primarily relevant for shareholders in a company.

While both metrics offer insights into financial performance, they cater to different stakeholders and perspectives within a business. ROI takes a broader view of investments, while ROE is more specific to shareholders’ interests.

Advantages and Disadvantages of ROI

Understanding the advantages and disadvantages of using ROI is crucial for making well-informed decisions:

Advantages of ROI

- Simplicity: ROI is easy to calculate and understand, making it accessible to a wide audience.

- Ease of Interpretation: A higher ROI percentage signifies a more profitable investment, simplifying the decision-making process.

- Comparative Analysis: ROI allows for straightforward comparisons between different investments or projects.

Limitations of ROI

- Time Value of Money: ROI does not account for the time value of money, potentially leading to inaccurate assessments for long-term investments.

- Inconsistent Time Periods: Comparing ROIs from different projects with varying time frames can be misleading. Consistency in time periods is essential for meaningful comparisons.

- Ignores Risk: ROI does not consider the risk associated with an investment. High risk might be present in conjunction with a high ROI, which the metric does not account for.

Recognizing these pros and cons empowers investors and decision-makers to use ROI effectively while being aware of its limitations.

Investing Recommendations for Better ROI

To enhance your chances of achieving a favorable ROI, consider the following recommendations:

- Reduce Average Cost per Share: In stock investing, aim to reduce your average cost per share by dollar-cost averaging and taking advantage of market dips.

- Seek High EPS Growth: Look for companies with a history of high Earnings per Share (EPS) growth, as this often indicates financial strength and potential for future returns.

- Track Portfolio Beta: Understanding the beta of your investment portfolio can help you manage risk. A beta below 1 suggests lower volatility compared to the market, while a beta above 1 indicates higher volatility.

- Consider Stock Options: Evaluate the use of stock options, such as call and put options, to manage risk and potentially enhance returns.

These recommendations are valuable strategies that can contribute to better ROI outcomes, but they should align with your risk tolerance and financial goals.

Additional Information and Further Calculators

While ROI is a critical metric, there are other calculators and tools that can aid in financial decision-making. Some of these include:

- Build vs. Buy Calculator: Helps businesses decide whether to build a solution in-house or buy an existing one.

- CAGR Calculator (Compound Annual Growth Rate): Calculates the annual growth rate of an investment over multiple years.

Exploring these additional tools can provide a more comprehensive toolkit for evaluating various financial scenarios and strategies.

FAQ

How to Calculate ROI Percentage?

Calculating the ROI percentage is straightforward using the formula: ROI=CG−C×100 Simply subtract the cost of the investment (C) from the gain (G), divide by the cost, and multiply by 100 to express it as a percentage.

How to Calculate ROI on Real Estate Investment?

To calculate ROI on a real estate investment, subtract all expenses, including purchase price, maintenance costs, property taxes, and property management fees, from the rental income. Then, divide the resulting gain by the total investment cost and multiply by 100 to get the ROI percentage.

These FAQs aim to provide clear and concise answers to common questions about ROI calculations.

Conclusion

In the world of finance, ROI is the compass that guides us toward profitable investments. It’s a metric that transcends industries and investment types, providing a common language for assessing financial performance. Armed with a solid understanding of ROI, its formula, and the advantages and disadvantages it carries, you can make more informed decisions about where to invest your hard-earned money. Remember, ROI is not just a number; it’s a tool that empowers you to take control of your financial future.

Check out the Compound Interest Calculator

- How do I calculate ROI?

- What is the easy formula for ROI?

- How do you calculate ROI for a project?

- What is a good ROI score?

- Is ROI calculated annually?

- How do you calculate ROI in months?

- Is ROI and ROCE the same?

- What is the difference between NPV and ROI?

- What is an example of ROI?

- Is a 5% ROI good?

- Is 30% ROI good?

- What is a good ROI for a startup?

- What is better a high or low ROI?

- What are the different types of ROI?

- Why is ROI important?

- How do you calculate 30% ROI?

- What is the difference between IRR and ROI?

- What is the ROCE called?

- Does ROI include capital?

- What is ROCE also known as?

- Which is better IRR or NPV?

- Can I use NPV to calculate ROI?

- Do you use NPV for ROI calculation?

- What does a 20% ROI mean?

- What are the two types of ROI?

- What does 100% ROI mean?

- What is an ROI of 50%?

- How good is a 20% ROI?

- How much ROI is normal?

- How do you calculate ROI for a business?

- Where is the ROI the highest?

- Can ROI exceed 100%?

- What is the best ROI for a small business?

- What investment has the best ROI?

- Can ROI be 300%?

- What is a poor ROI?

- What does ROI 40% mean?

- What causes ROI to decrease?

- What is the most common ROI?

- What is ROI strategy?

- What are ROI strategies?